When TechCrunch asked Google for confirmation, it did not dispute our findings or assertions. A smart debit card and checking accounts could pave the way for Google offering banking, stock brokerage, financial advice or robo-advising, accounting, insurance or lending. While once the industry joke was that every app eventually becomes a messaging app, more recently it’s been that every tech company eventually becomes a financial services company. The long-term implications are even greater. Brands might be willing to buy more Google ads if the tech giant can prove they drive a sales lift. Depending on its privacy decisions, Google could use transaction data on what people buy to improve ad campaign measurement or even targeting.

It could potentially charge interchange fees on purchases made with the card or other checking account fees, and then split them with its banking partners. A “Google Pay Card” would vastly expand the app’s use cases, and Google’s potential as a fintech giant.īy building a smart debit card, Google has the opportunity to unlock new streams of revenue and data.

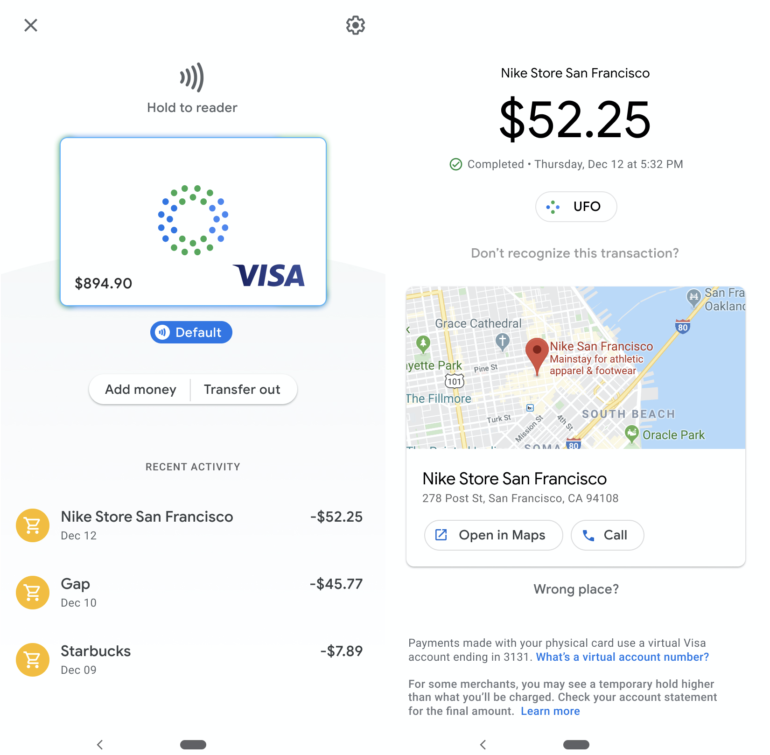

Currently, Google Pay only allows online and peer-to-peer payments by connecting a traditionally issued payment card. Another source confirmed that Google has recently worked on a payments card that its team hopes will become the foundation of its Google Pay app - and help it rival Apple Pay and the Apple Card. The card will be co-branded with different bank partners, including CITI and Stanford Federal Credit Union.Ī source provided TechCrunch with the images seen here, as well as proof that they came from Google. It connects to a Google app with new features that let users easily monitor purchases, check their balance or lock their account. The Google card and associated checking account will allow users to buy things with a card, mobile phone or online. Would you pay with a “Google Card?” TechCrunch has obtained imagery that shows Google is developing its own physical and virtual debit cards.

0 kommentar(er)

0 kommentar(er)